2018 Financial Summary

This is a continuation of my series of wrapping up the year from a personal finance standpoint, which I started in 2017 here and here. Again, I’ll break down my income, expenses, savings, and investments. I think you’ll find that I’m not as frugal as other financial independence bloggers, yet I’m still able to save so much money.

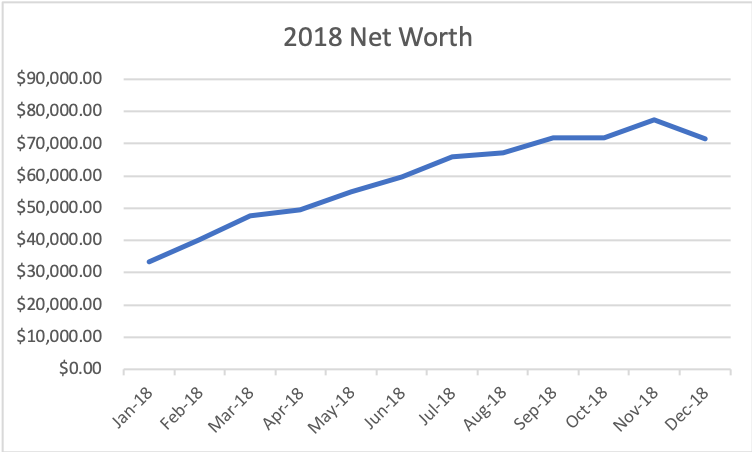

Since almost all of my money is tied up in the stock market through index funds, my net worth can fluctuate greatly. The market hasn’t been great in 2018 due to the last quarter, and my net worth reflects that. My investment portfolio allocation has pretty much been the same since the end of 2017. It’s still at 100% stocks. I generally have 10%-20% of that in international stock. The rest is in US stock with 80% in the large cap market, 16% in the mid cap market, and 4% in the small cap market. You just need a few index funds or even only one to be invested in the whole stock market, which is what I recommend as the best way to get to financial independence.

My savings and investments in 2018 all came through retirement accounts. Every year, I max out my Roth IRA. I did that in 2018 for the year of 2017, and I plan to max out for 2018 with $5,500 at some point as well. Keep in mind that you have until Tax Day of the next year to contribute to an IRA for a given year. I’m always more focused on maxing out my 401(k), just because I can only do that in the year of contributing. The limit for 401(k) for 2018 was $18,500, which I missed by around $200. I did max out my 457(b) from my last job, which has the same contribution limit as 401(k). My old job also took out 4.5% of my paycheck for 414(h) contribution, so that came out to be around $1,900 in total for 2018. Out of my pre-tax income from working salary in 2018, I put away almost $39,000. A majority of my money right now is held pre-tax. I’ll have to pay taxes on that when I retire, but my tax rate will be much lower at that point without income.

Now how do I contribute so much to retirement accounts? I willingly give myself a big paycut to do so. In my opinion, this is the best way to save. It forces one to live on less. To max out the 457(b), I was contributing 75% of my paycheck for the first 6 months of 2018 at my old job. That was the max percentage allowed by that employer. With my new job, I lived on 100% of my paycheck going to 401(k) for the last 3.5 months of 2018. I actually still am living on that to max out for 2019. That’s right. I’m living on literally no income right now. I’ve only been paid by new job once so far, but I did get a few paychecks for leftover PTO from the old job. Some might think living on so little is impossible, but I actually find it pretty easy.

2018 has been a pretty big year in terms of personal finance and career. I made a total career change at the end of August, which I mentioned here. I am now a professional software developer, which I have enjoyed a lot thus far in the first few months of my first job at it. The personal finance significance is that software developers do get paid rather well, so I increased the earning potential of my working career with this one move.

This career change has also brought another big life change. I finally moved out of my parents’ place in the Bronx, NY and moved to Pittsburgh, PA where my job’s located. I discussed here on how I’ve lived with my parents my whole life and why I continued to do so well after I could afford to live on my own. The reasoning boiled down to saving money for both myself and my parents. Right now, I’m paying housing expense for two places. I’m still paying for the maintenance and common charges for the co-op in the Bronx where my parents stay. That comes out to $850 every month, which includes costs like property tax and water. I’m also paying $600 every month in rent for a studio in Pittsburgh. I had some one-time expenses with moving like getting a mattress and bed frame for $217 altogether. I really didn’t buy much else. I do try to live a minimalist life.

I was very conscious of how I’d spend my money on housing when I was looking for a place to live in Pittsburgh. While other new hires at my company are spending double what I pay for rent, I went bare bones for my accomodations. Personally, I really don’t need much to live on. I’m paying $600 for about 500 square feet to myself and a shared kitchen that I don’t even use. Of course, lifestyle preferences vary a lot from person to person. Just know that housing is the biggest expense in an average person’s life. Cutting down this one expense even by a bit can result in huge savings. Scott Trench talks a lot about cutting down on the big expenses to create financial runway in his book Set for Life, which has made a rather big impact on my own life.

The second biggest expense for an average person is transportation, which is usually a car. People always underestimate how much their car is costing them. Thankfully, I’ve managed to cut this expense almost completely by having chosen a place to live within walking distance of where I work. Most people at my office do have a car, so I’m certainly not the norm. My commute is about 20 minutes to walk. I can always use rideshare or public transportation if I want to go farther. I actually get a monthly bus pass for free as one of the perks from my new job, but I rarely have to use it. When I lived in NYC, I would get a subway/bus pass for $121 every month paid with pre-tax dollars and commute about 1.5 hours to work. I did spend $495 in 2018 for bus travel between NYC and Pittsburgh though.

The third biggest expense for an average person is food, and here is where I don’t really cut back. I don’t care to cook at all, so I don’t. I don’t eat breakfast, and lunch is provided by my job on workdays. Dinners and meals on weekends are usually takeout. No, I don’t meticulously plan out my meals or meal prep ahead of time like the other financial independence bloggers do. I just try to keep my food cost under $7-$8 per day on average. However, I actually started dieting in 2019 with a version of intermittent fasting that I have been able to stick with pretty consistently. It’s helping cut costs and hopefully my body fat percentage.

Below is a chart with my recurring expenses from 2018. As you can see, housing took up an overwhelming majority. If you can reduce that expense, you take a great burden off and not have to worry as much as when spending elsewhere. I really recommend breaking down expenses like this to show exactly where money is going.

| Expense Type | Recurring Cost | Times Paid | Extra Cost | Total Cost |

|---|---|---|---|---|

| Maintenence/Common Charges for Bronx | $850.57 | 12 | $10,206.84 | |

| Renovation Common Charge for Bronx | $46.97 | 7 | $328.79 | |

| Rent for Pittsburgh | $600.00 | 6 | $97.00 | $3,697.00 |

| Electricity for Pittsburgh | $36.89 | 1 | $36.89 | |

| Internet for Bronx Part 1 | $75.29 | 2 | $150.58 | |

| Internet for Bronx Part 2 | $27.48 | 9 | $10.00 | $257.32 |

| Music Streaming | $2.50 | 12 | $30.00 | |

| Dental Insurance | $13.50 | 4 | $54.00 | |

| Gym in Pittsburgh | $25.00 | 4 | $100.00 | |

| Internet for Pittsburgh | $20.00 | 3.5 | $70.00 | |

| Cell Phone Service | $20.00 | 12 | $240.00 | |

| Subway NYC (pre-tax) | $121.00 | 7.5 | $907.50 | |

| Electricity for Bronx (average) | $64.50 | 5 | $322.50 | |

| Food/Groceries (estimate) | $200.00 | 12 | $2,400.00 | |

| Bus between NY and PA (average) | $123.625 | 4 | $494.50 | |

| Haircut with Tip | $20.00 | 4 | $80.00 |

Let’s go over expenses outside of recurring ones. The only travel I did was to Las Vegas in the very, very beginning of 2018, which I discussed here. Including a silly $300 bet that I made, I spent about $800 on that trip. The flight was paid for with Delta Air Lines miles. I also redeemed Chase Ultimate Rewards points for several flights for my parents, and we still have so many points left over.

Unlike 2017, I didn’t buy a phone or a computer in 2018. I did buy a used Apple Watch for around $100 and a used iPad with AppleCare+ for $250. I ended up not using the iPad much, so I’m giving it to my dad. If you noticed from 2017, giving parents my old electronic devices is a consistent theme in my life. I’m planning to buy a new iPhone this year, so I’ll give my current one to my parents again. They’re excited to both have iPhones. I did also buy a brand new Xbox One X, a new Nintendo Switch, and games for each. After some discounts and an old Xbox One trade-in, I spent just over $600 on those consoles and games.

I spent $340 on some new contact lenses in the last week of 2018. I wear special ones, and I mentioned in 2017 how they were costing me over $500 for a pair. Thankfully, the vision insurance at my new job gets me an amazing discount. It was such a pleasant surprise when I went to my eye doctor’s office. I don’t have to pay anything for my vision insurance, and I pay just $13.50 every month for dental. Also, I now have a high deductible health insurance with no monthly premium to pay for. I paid barely anything for insurance at my old job too, so it’s nice to still have healthcare costs very low. My new health insurance even gives me access to a program called Active&Fit Direct that lets me go to 9,000+ gyms across the country for only $25 per month. On top of that, I paid $150 for 15 dance classes to get some fun physical activity in. I still have about half left.

I did my usual buying and selling of sneakers for extra pocket money and credit card rewards, but I ended up keeping some expensive ones for myself. I spent about $860 on shoes and some pants in 2018, but I’m trying to sell a pair now to get some money back. If you think those expenses are bad, the worst was losing around $880 from gambling in daily fantasy sports and spending $170 in related costs. I’m still net positive in DFS in my lifetime with profit around $1,600. I’m definitely retired from that now though. I’ve learned some hard lessons.

Speaking of side hustles, I didn’t do much in 2018. I only opened a few bank accounts and made $775 from the bonuses. That’s a far departure from the $8,745 in bonus money from bank accounts that I opened for my parents and myself in 2017. I did ramp up the opening of credit cards for my parents in 2018. We ended up opening 10 cards between the three of us and earning hundreds of thousands of points yet again. I don’t see myself slowing down opening credit cards, just because it’s so easy. We really have more points and miles than we know what to do with. I’m just happy that I’m able to pay for my parents’ travel without really even paying anything. These rewards points aren’t reflected in my net worth, but they could be cashed out if I were ever to be in a bind.

I was very focused on getting my career change off the ground. That came with the biggest single expense of all. I had to spend $15,680 for the bootcamp program to help me get into the field I am now, but $2,650 of that was paid in 2017. Thankfully, doing the program seems to have paid off. I discussed here about how doing it part-time allowed me to make the career change while continuing to have steady income, so I was still building my net worth throughout the program. You can see below how it increased in 2018.

2017 was really the first year I took saving and investing seriously. In 2017-2018, I was able to save around $40,000 each year. That was well over half my pre-tax income, and I plan to increase my savings rate as I increase my income. I’ve already gotten a higher salary with the recent career change, and it’s only going to get higher as time goes on. Putting away even just $40,000 every year for a decade would yield $400,000 in savings alone. That’s not anywhere close to what I’d need to retire in my mid 30s, but it’s no chump change either. That’s not taking into consideration of compounded returns, which I discussed here when recommending putting away money to invest early and often. I think I’ve put myself on a good path to financial independence thus far. 2018 was great for my finances, and here’s hoping for an even bigger year in 2019.